The FintechZoom.com Nikkei 225 section serves as a key resource for anyone interested in the Japanese stock market. This platform offers live updates, detailed charts, and expert insights into the index that tracks 225 top companies on the Tokyo Stock Exchange. Users can find real-time quotes, historical data, and market news all in one place.

Whether you are a beginner or a seasoned trader, FintechZoom.com provides tools to help you make informed decisions about the Nikkei 225. The site focuses on accuracy and ease of use, making it simple to stay on top of market changes. This guide will break down the features and benefits in detail, so you can get the most out of FintechZoom.com Nikkei 225 coverage.

How FintechZoom Tracks the Nikkei 225 in Real Time

FintechZoom.com uses direct feeds from the Tokyo Stock Exchange to deliver up-to-date information on the Nikkei 225. This means you get the latest price, daily highs and lows, and percentage changes without delay. For example, on November 21, 2025, the index stood at 48,802.40 points during morning trading, showing a drop of 2.05% from the previous close.

The platform refreshes data every few seconds, which is crucial for day traders who need to react quickly to market shifts. Beyond basic numbers, it includes volume traded and opening prices. This setup helps users spot trends early, such as when tech stocks push the index higher. By integrating these elements, FintechZoom.com ensures you have a complete picture of the Nikkei 225’s current state.

The real-time tool on FintechZoom.com Nikkei 225 also allows customization. You can set alerts for specific price levels or percentage moves. This feature is handy for investors watching for buy or sell signals. For instance, if the index nears a support level around 48,000 points, an alert can notify you right away. The site supports mobile access too, so you can check updates on your phone during commutes or breaks. Accuracy comes from verified sources, but FintechZoom advises cross-checking with other platforms for major decisions. Overall, this tracking system makes following the Nikkei 225 straightforward and reliable for all users.

Key Components of the Nikkei 225 as Covered on FintechZoom

The Nikkei 225 includes 225 leading Japanese companies, selected based on liquidity and sector balance. FintechZoom.com lists top performers like Toyota Motor Corporation, with a market cap over $51 billion, and Sony Group at $126 billion. These firms represent sectors such as technology, consumer goods, and finance. The index is price-weighted, meaning higher-priced stocks have more influence.

FintechZoom explains this calculation method clearly, showing how it differs from cap-weighted indices like the S&P 500. Annual reviews in September ensure the list stays relevant, with changes applied in October. This process keeps the Nikkei 225 reflective of Japan’s economy, helping users understand why certain companies drive movements.

FintechZoom.com breaks down sector weights in the Nikkei 225, highlighting technology’s role with companies like Keyence Corp and Tokyo Electron. These firms focus on scientific instruments and semiconductor equipment, often leading gains during tech booms. The site provides profiles for each major component, including recent performance and news.

For example, automakers like Honda and Toyota react strongly to currency changes. FintechZoom’s coverage includes charts showing how sector shifts affect the overall index. This detail helps investors identify opportunities, such as buying into undervalued industrial stocks. By offering this breakdown, the platform turns complex data into actionable knowledge for readers.

Also, Discover Fintechzoom.com Corn Market.

Historical Performance Insights from FintechZoom.com Nikkei 225

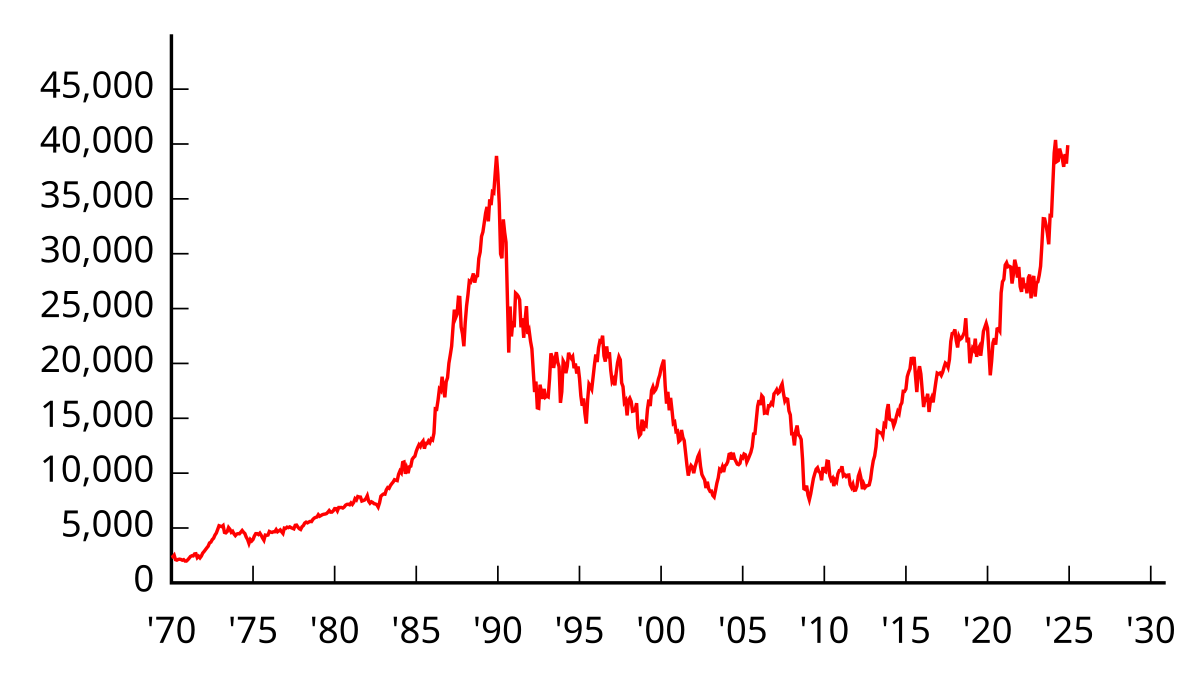

FintechZoom.com offers extensive historical data on the Nikkei 225, going back decades. Users can view charts showing peaks, like the all-time high near 39,000 points in 1989, and lows during events such as the 2008 financial crisis. The site uses interactive tools to zoom in on specific periods, such as the recovery after the 2011 earthquake. This visual aid reveals patterns, like how the index often rebounds after geopolitical tensions ease. It includes comparisons to economic indicators, such as GDP growth, to explain long-term trends. For investors, this history shows the index’s volatility, with average annual returns around 5-7% over 30 years. Such insights help in planning long-term strategies.

Looking at recent years on FintechZoom.com Nikkei 225, the index climbed from about 20,000 points in 2016 to over 40,000 by 2024, driven by tech and export growth. The platform analyzes factors like Abenomics policies that boosted stocks. Users can download CSV files of past data for personal analysis. FintechZoom points out key events, such as the COVID-19 dip in 2020 followed by a swift rally. This section also covers dividend yields and P/E ratios over time, aiding value investors. By providing this depth, FintechZoom helps users avoid common pitfalls, like chasing highs without considering historical context.

Market Influences on the Nikkei 225 Explained by FintechZoom

Currency fluctuations heavily impact the Nikkei 225, as FintechZoom.com details. A weaker yen benefits exporters like Toyota, increasing their overseas earnings when converted back. The site tracks yen-dollar rates alongside index moves, showing correlations. For example, a 10% yen drop often leads to a 5-8% index gain. FintechZoom offers hedging tips using futures contracts to manage this risk. Geopolitical events, such as trade tensions with China, can cause drops, as seen in past US-Japan disputes. The platform updates users on these influences daily, helping them anticipate shifts.

Natural disasters pose another risk, according to FintechZoom.com Nikkei 225 coverage. Japan’s location makes it prone to earthquakes, like the 2011 event that halted production and dropped the index by 10%. The site discusses recovery patterns, noting increased government spending often aids rebounds. FintechZoom includes insurance sector analysis, as claims rise post-disaster. Global economic slowdowns, like recessions in Europe, also affect the index through reduced demand for Japanese goods. By outlining these factors, FintechZoom equips users to build resilient portfolios, perhaps by diversifying beyond export-heavy stocks.

Expert Analysis and Forecasts on FintechZoom.com

FintechZoom.com features daily expert reviews of the Nikkei 225, drawing from analysts worldwide. These pieces cover short-term predictions, like expected moves based on upcoming earnings reports. For instance, if tech giants report strong results, the index might rise 1-2%. The site includes long-term forecasts, projecting 3-5% annual growth tied to Japan’s economy. Analysts discuss risks, such as inflation or interest rate hikes by the Bank of Japan. FintechZoom ensures diversity in views, presenting bullish and bearish cases. This balance helps users form their own opinions rather than relying on one perspective.

In-depth articles on FintechZoom.com Nikkei 225 explore technical indicators, such as moving averages and RSI levels. If the 50-day average crosses above the 200-day, it signals a buy. The platform teaches how to use these for entry points. Forecasts often tie into global trends, like AI adoption boosting semiconductor stocks. FintechZoom updates these regularly, especially after major news like policy changes. Users benefit from practical advice, such as adjusting positions ahead of volatility. This section turns raw data into strategic guidance, making it valuable for active traders.

Investment Strategies Using FintechZoom Resources

For beginners, FintechZoom.com Nikkei 225 suggests starting with ETFs that track the index, like the iShares Nikkei 225 ETF. This approach offers exposure without picking individual stocks. The site guides on low-cost options and how to buy through brokers. Diversify by mixing with bonds or international assets to reduce risk. FintechZoom provides calculators to estimate returns based on historical data. Monitor news sections for entry timing, such as buying during dips. Long-term holding suits novices, aiming for compound growth over years. The platform warns against emotional trading, stressing research over hype.

Advanced users can leverage CFDs on FintechZoom.com Nikkei 225 for short-term plays. These allow betting on rises or falls with leverage, amplifying gains but also losses. The site explains risk management, like stop-loss orders at 2% below entry. Options trading is another strategy, using calls for upside potential. FintechZoom analyzes volatility, recommending strategies during high VIX periods. Portfolio diversification across sectors, tracked via the site’s tools, minimizes losses. Expert tips include hedging with yen futures. This depth helps seasoned investors optimize returns while controlling exposure.

Comparing Nikkei 225 to Other Indices via FintechZoom

FintechZoom.com allows side-by-side views of the Nikkei 225 against the Dow Jones or Hang Seng. This reveals correlations, like how US tech rallies often lift Japanese counterparts. The site uses charts to show performance differences; for example, Nikkei might lag during yen strength while others gain. Comparisons highlight sector focuses: Nikkei leans on manufacturing, unlike Nasdaq’s tech dominance. FintechZoom discusses diversification benefits, suggesting a mix for global exposure. Historical data shows Nikkei recovering slower from crises than S&P 500. This tool aids in asset allocation decisions.

When viewing FintechZoom.com Nikkei 225 next to emerging market indices, patterns emerge. During Asia growth spurts, Nikkei often outperforms European ones. The platform provides correlation coefficients, such as 0.7 with Shanghai Composite. Users can spot arbitrage opportunities, like trading based on time zone differences. FintechZoom warns of risks in comparisons, as local policies differ. For instance, Japan’s aging population affects long-term growth versus India’s youth. This section equips investors to build balanced international portfolios using solid data.

Tools and Features for Enhanced User Experience on FintechZoom

Interactive charts on FintechZoom.com Nikkei 225 let users overlay indicators like Bollinger Bands or MACD. Customize time frames from minutes to years for detailed analysis. The site offers export options for Excel, useful for personal models. News feeds filter by relevance, showing only Nikkei-related stories. Mobile apps sync with the web version for seamless access. FintechZoom includes community forums for discussing trends. These features make the platform user-friendly, saving time on research.

FintechZoom.com provides educational resources tied to the Nikkei 225, like tutorials on reading charts. Glossaries explain terms such as “price-weighted index.” Webinars cover topics like market timing. The site tracks user preferences to suggest content, enhancing personalization. Security features protect data during logins. Overall, these elements create a comprehensive hub for learning and trading.

Staying Updated with FintechZoom.com Nikkei 225 News

Daily news updates on FintechZoom.com cover earnings, mergers, and policy changes affecting the Nikkei 225. Articles detail impacts, such as how a Bank of Japan rate cut boosts stocks. The site sources from reliable outlets, ensuring credibility. Push notifications alert on breaking events, like a major company’s scandal. Archives allow searching past stories for context. This keeps users informed, preventing surprises in their investments.

FintechZoom.com Nikkei 225 includes sector-specific news, focusing on tech or auto developments. For example, EV advancements at Toyota get highlighted. The platform analyzes how global news, like US elections, ripples to Japan. Video summaries offer quick overviews. By combining text and multimedia, FintechZoom makes staying current easy and engaging.

Practical Tips for Maximizing FintechZoom.com Nikkei 225

Set up a dashboard on FintechZoom.com with favorite Nikkei 225 metrics for quick views. Combine with external tools like economic calendars for better timing. Review historical patterns before trades to avoid repeats of past mistakes. Join the site’s alerts for volatility spikes. Diversify based on insights, allocating 20% to Nikkei ETFs. Regularly update your knowledge through their resources to adapt to market changes.

For risk control, use FintechZoom.com data to set realistic goals, like 4% annual returns. Test strategies with paper trading before real money. Monitor currency pairs alongside the index. Share insights in forums for feedback. This hands-on approach turns the platform into a powerful ally for success.