The fintechzoom.com cac 40 section offers a key resource for anyone interested in the French stock market. This guide breaks down everything you need to know about the CAC 40 index and how fintechzoom.com makes it easy to follow. Whether you are new to investing or have years of experience, you will find useful details here. We cover the basics, features on the site, top companies, past results, recent changes, and tips for getting started. By the end, you will have a clear path to using fintechzoom.com cac 40 for your needs.

What Is the CAC 40 Index?

The CAC 40 index tracks the 40 biggest companies listed on the Euronext Paris stock exchange. It acts as a main measure of how the French stock market performs overall. Started in 1987 with a base value of 1,000 points, it includes firms from various fields like luxury goods, energy, and banking. The index gets updated every 15 seconds during trading hours, giving a real-time view of market moves. Investors use it to gauge economic health in France and Europe.

To pick companies for the CAC 40, a committee looks at market size, trading volume, and free-float shares. This means only shares available to the public count, not those held by insiders. The index uses a weighted system where bigger companies have more impact. For example, a large firm like LVMH can sway the index more than a smaller one. This setup helps reflect the true strength of the French economy. Changes happen quarterly to keep the list current. If a company drops in value or faces issues, it might get replaced. This process ensures the index stays relevant for investors tracking European markets.

The CAC 40 covers about 20% of the total market value on Euronext Paris. It includes global players that operate far beyond France. Sectors like consumer goods and industrials dominate, but tech and healthcare also appear. Trading runs from 9:00 AM to 5:30 PM CET on weekdays. The index responds to global events, such as U.S. economic news or EU policies. For instance, trade deals or interest rate changes can cause quick shifts. Understanding these factors helps predict moves. Many funds and ETFs base their holdings on the CAC 40, making it a popular choice for diversified investing.

How FintechZoom.com CAC 40 Covers the French Market

Fintechzoom.com cac 40 provides real-time tracking tools for the index. Users can see live prices, daily highs and lows, percentage changes, and trading volumes. The site pulls data from trusted sources like stock exchanges and financial groups. This setup lets you monitor the market without delay. Interactive charts allow zooming in on specific time frames, from minutes to years. You can set alerts for price levels or news updates. These features suit both casual viewers and active traders. The basic version is free, but premium options add deeper tools like technical studies.

On fintechzoom.com cac 40, you find sections for index basics, including how it gets calculated. The site explains the market-cap weighted formula in simple terms. It shows the sum of each company’s market value divided by the total, adjusted for shares. This helps users grasp why certain firms matter more. The page also lists benefits like diversification across sectors. For risks, it notes market ups and downs and fees for investing. Links lead to related topics, such as ETFs tied to the CAC 40. This structure makes the site a one-stop spot for learning and tracking.

Fintechzoom.com cac 40 includes tips on investing strategies. It suggests spreading funds across index companies to cut risk. Long-term holding gets highlighted as a way to ride out short-term drops. The site warns about fees from brokers or funds that can eat into returns. It points out liquidity advantages since the index features large, traded firms. Users can compare the CAC 40 to other indices like the DAX or FTSE 100 through linked pages. This comparison aids in seeing how French stocks stack up globally. Overall, the coverage aims to build user confidence in making choices.

Also, Master S&P 500 Today at Fintechzoom.com SP500.

Key Components of the CAC 40: Top Companies in 2025

In 2025, the CAC 40 features leading firms across industries. LVMH tops the list with its luxury brands like Louis Vuitton and Dior. Its market cap leads due to strong global sales. Hermès follows, known for high-end handbags and scarves. L’Oréal ranks high in beauty products, with brands like Maybelline. Airbus stands out in aerospace, building planes for airlines worldwide. Schneider Electric focuses on energy management and automation. TotalEnergies handles oil and gas, shifting toward green energy. Safran makes aircraft engines and equipment. These companies drive the index’s value.

Other notable members include BNP Paribas in banking, offering services from loans to investments. Sanofi leads in pharmaceuticals, developing drugs and vaccines. EssilorLuxottica dominates eyewear with brands like Ray-Ban. Kering owns Gucci and Yves Saint Laurent in fashion. Air Liquide supplies industrial gases for manufacturing. Pernod Ricard produces spirits like Absolut Vodka. Danone focuses on food like yogurt and water. Vinci builds infrastructure like roads and airports. These firms represent France’s economic strengths. The list gets reviewed regularly, with possible swaps based on performance. For example, if a company’s value falls sharply, a rising star might take its place.

The CAC 40’s makeup shows a mix of old and new sectors. Luxury and consumer goods make up a big part, reflecting France’s brand power. Energy and industrials add stability, while tech firms like Dassault Systèmes bring innovation. Banking and insurance provide financial backbone. This balance helps the index weather economic shifts. Investors can check current weights on sites like fintechzoom.com cac 40. Knowing the top players aids in spotting trends, such as growth in renewables or luxury demand. It also highlights risks, like reliance on global trade for exports.

Historical Performance of the CAC 40

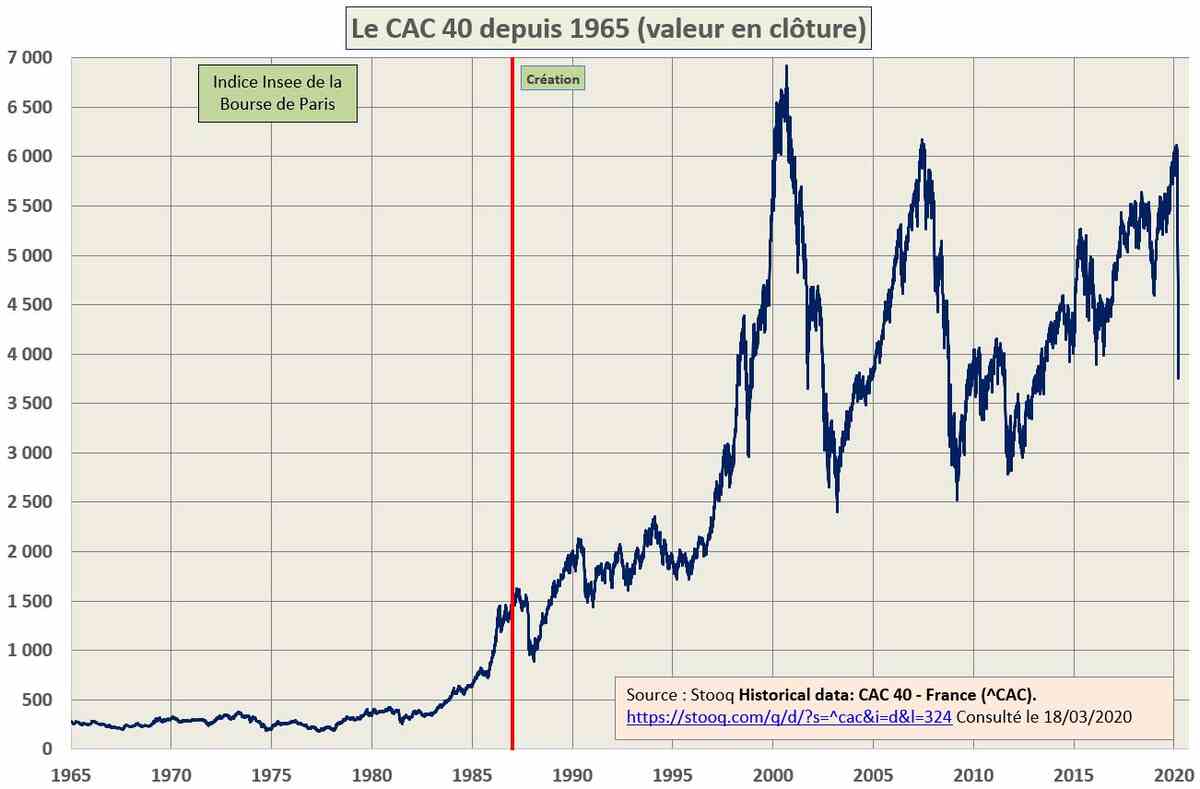

The CAC 40 started at 1,000 points in 1987. By 1990, it reached around 1,800, showing early growth from economic reforms. The 1990s saw ups and downs, with a peak near 4,000 in 1998 amid tech boom. The dot-com crash in 2000 dropped it to about 2,400 by 2003. Recovery followed, hitting over 6,000 in 2007 before the financial crisis. In 2009, it bottomed at around 2,500 due to global banking woes. The 2010s brought steady climbs, reaching 5,500 by 2015. The COVID-19 pandemic in 2020 caused a sharp fall to 3,700, but quick rebounds pushed it past 7,000 by 2021.

From 2022 to 2024, the index faced inflation and rate hikes but grew to over 8,000 in early 2025. Key events shaped this path, like EU integration boosting trade in the 1990s. The 2008 crisis highlighted banking risks, leading to stricter rules. Post-COVID stimulus aided recovery, with tech and luxury sectors leading. Annual returns varied: positive in growth years like 2019 at 26%, negative in crashes like 2008 at -42%. Long-term, it averaged about 7% yearly gains, including dividends. This history shows resilience but also volatility from global ties.

Major peaks include 6,922 in 2000 and 8,271 in October 2025. Troughs hit 2,401 in 2009 and 3,632 in 2020. Trends point to cycles: booms from innovation, busts from crises. European politics, like Brexit, caused dips in 2016. Energy prices affected it in 2022. Comparing to the S&P 500, the CAC 40 lagged in tech-heavy periods but matched in diversified growth. Investors use this data to spot patterns, like recoveries taking 2-5 years. Fintechzoom.com cac 40 charts help visualize these shifts for better planning.

Here is a visual of the CAC 40’s long-term path:

Current Trends in the CAC 40 as of October 2025

In October 2025, the CAC 40 hovered around 8,200 points, showing caution after a high of 8,271 earlier in the month. On October 29, it closed at 8,200.88, down 0.19% from the prior day. Earlier, it dipped to 7,918 on October 10 amid political unrest in France. Recovery followed, with gains on October 21 at 8,258.86. Factors include U.S. inflation data and EU trade talks. The index rose 3.87% over the month but faced pressure from budget debates. Luxury stocks like LVMH held steady, while banks varied.

Political issues in France, such as government stability, weighed on sentiment. Investors watched for budget votes that could affect taxes and spending. Global optimism from U.S.-China talks helped lift it mid-month. Weekly gains reached 3.24% in mid-October, driven by earnings from firms like Airbus. However, dips came from steel tariffs and trade fears. The index showed a rising long-term channel, suggesting positive bias despite short-term pulls. Compared to September, October saw more volatility, with daily swings up to 1-2%. Fintechzoom.com cac 40 updates these in real-time for quick checks.

Looking ahead, analysts see potential for 8,500 if inflation eases. Risks include energy costs and geopolitical tensions. ESG focus grows, with the CAC 40 ESG variant gaining traction for sustainable picks. Companies like TotalEnergies shift to green, boosting appeal. Trading volume stayed high, indicating interest. For October, average close was about 8,100, up from September’s 7,900. This trend aligns with broader European markets, where DAX fell similarly. Users on fintechzoom.com cac 40 can set alerts for these levels to stay ahead.

How to Use FintechZoom.com CAC 40

Start by visiting fintechzoom.com and exploring the live tracker. Set up a free account for personalized alerts on price drops or news. Use charts to analyze patterns, like support at 8,000 points. The site links to ETFs for easy investing without picking single stocks. Open a brokerage account to buy funds like the Lyxor CAC 40 ETF. Track daily updates to time entries, avoiding high volatility days. Combine with world indices page for comparisons. This approach builds a routine for monitoring.

For deeper use, premium features on fintechzoom.com cac 40 offer technical tools like moving averages. Spot trends by overlaying 50-day and 200-day lines. Read the calculation section to understand weights, helping predict impacts from earnings. Diversify by noting sector balances. If luxury weighs heavy, add exposure elsewhere. The site advises long-term holds over short trades due to fees. Practice with historical data to test strategies. This hands-on method turns the site into a daily tool.

Common steps include checking morning opens for overnight news effects. Use volume data to gauge interest. If low, expect quiet days. Fintechzoom.com cac 40 FAQs answer setup questions. For beginners, start small with index funds. Track performance against goals, adjusting as needed. This systematic way maximizes the site’s value for real results.

Benefits and Risks of Investing in FintechZoom.com CAC 40

Benefits include access to France’s top firms for growth potential. Diversification across 10 sectors reduces single-stock risk. Low costs come from ETFs, often under 0.2% fees. Liquidity allows quick buys and sells. Fintechzoom.com cac 40 makes tracking simple, aiding timely decisions. Exposure to global brands like L’Oréal offers stability. Historical averages of 7% returns attract long-term savers. It’s a hedge against local markets for international investors.

Risks involve market drops from events like recessions. Weighted setup means big firms dominate, amplifying their issues. Fees add up in active trading. Political changes in Europe can cause swings. Fintechzoom.com cac 40 notes volatility, advising caution. Currency shifts affect non-euro holders. Limited to 40 firms misses smaller growth stories. Understand these to balance portfolios.

To manage, use stop-loss orders on fintechzoom.com cac 40 alerts. Mix with bonds for safety. Stay informed on news to avoid surprises. This balanced view helps sustain investments.

In summary, fintechzoom.com cac 40 serves as a solid hub for understanding and tracking the index. With its tools and info, you can make smarter choices in the French market. Keep checking for updates to stay current.